Advice on the equalization levy

Content of this page

Are you an employer and have questions about paying your equalization levy? Our equalization levy team will be happy to help you.

If you have any questions about reporting the equalization levy, please contact the relevant employment agency.

Who pays the equalization levy?

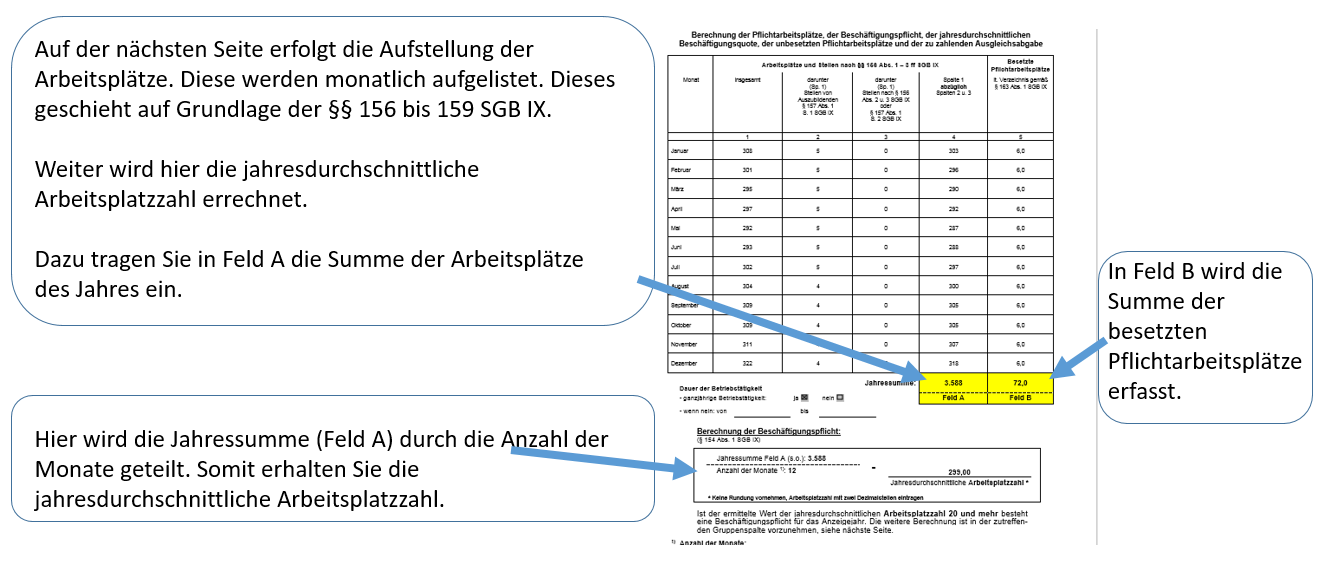

Employers who have an annual average of at least 20 jobs per month are legally obliged to employ people with severe disabilities.

If they do not meet the set quota of 5%, they have to pay an equalization levy.

What is the purpose of the equalization levy?

The equalization levy is not a substitute for employing people with severe disabilities. It provides financial compensation for employers who incur additional costs as a result of employing people with severe disabilities. At the same time, it represents an additional incentive for every employer to give severely disabled people a chance in working life, in addition to their social obligation.

How do I pay the equalization levy?

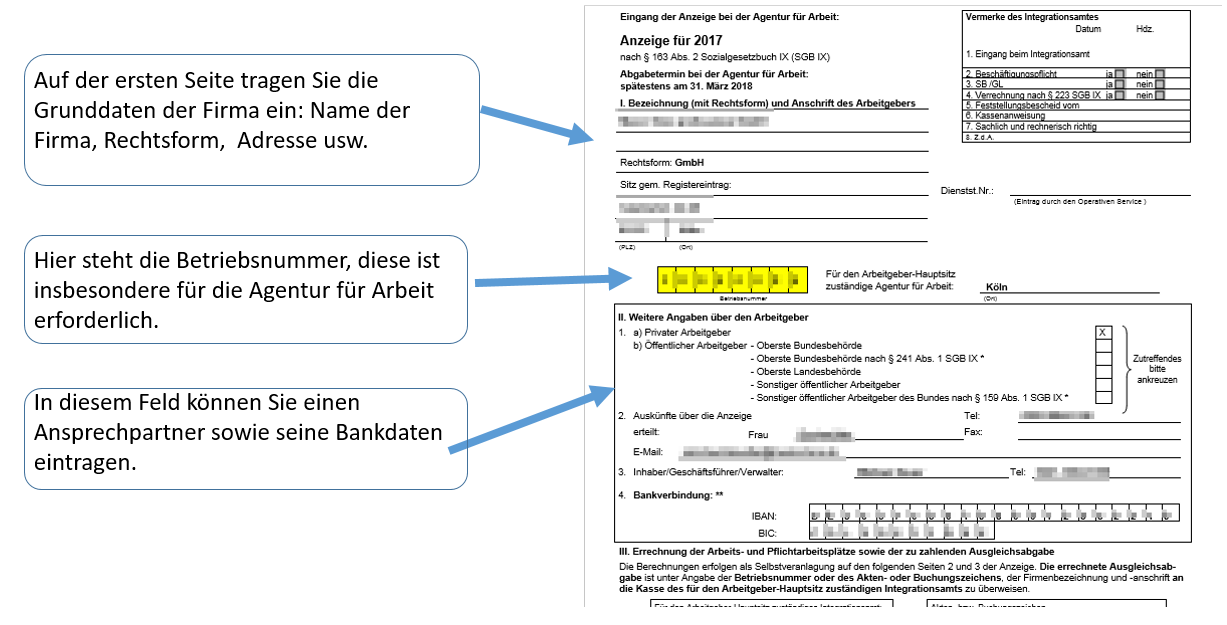

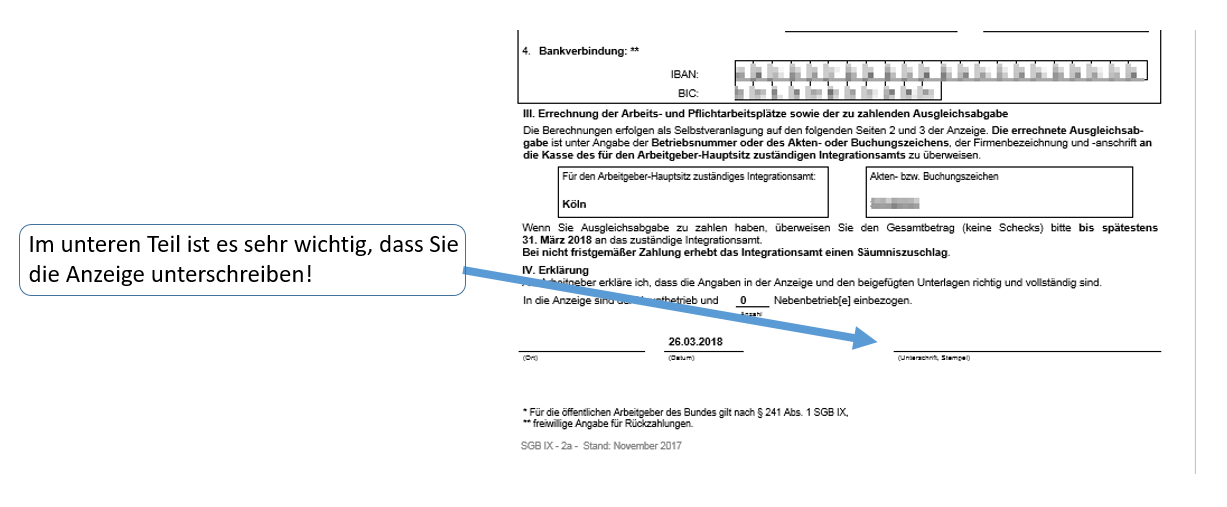

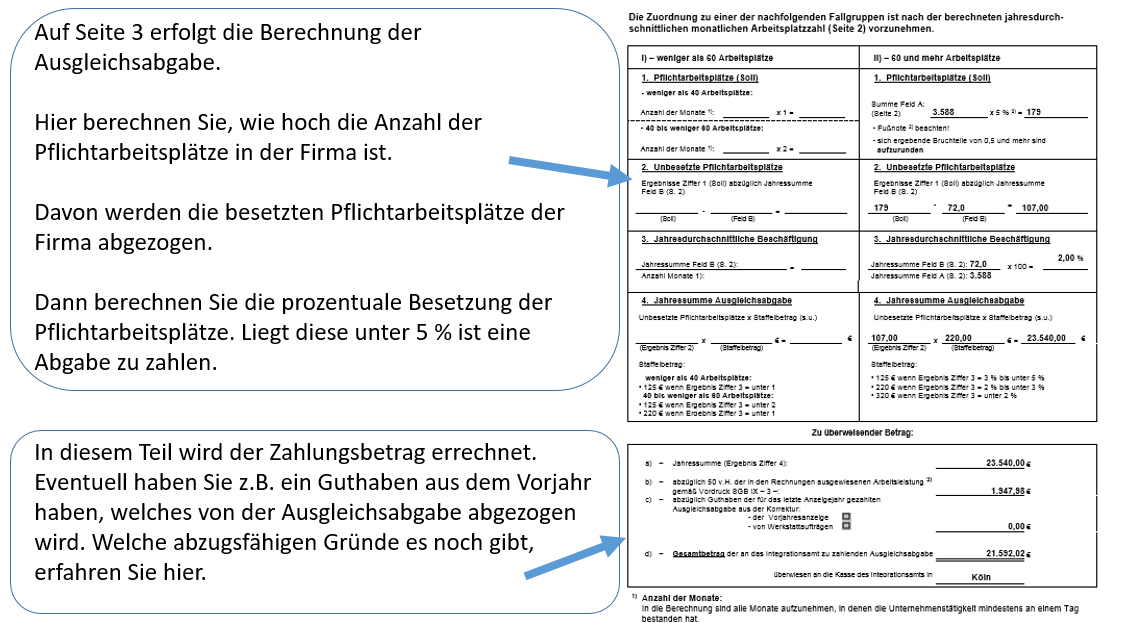

The notification is submitted using the IW Elan program. The notification is entered into IW Elan by you as the employer and sent to the employment agency responsible for the location of the company. The Elan software can be used to calculate the mandatory jobs and the equalization levy to be paid.

Here you can access the previews of the respective forms:

For data protection reasons, only your agency can help you with this without restriction.

- If you have any questions about reporting the equalization levy, please contact the relevant employment agency.

At the same time the calculated levy must be paid to the LVR Inclusion Office by March 31 of each year.

- If you have any questions about paying the equalization levy, please contact our equalization levy team. We will be happy to help you.

Information video

Associated services of the LVR

Here you will find detailed information on the benefits and eligibility requirements.

Please be aware of the fact that these information are only available in German.